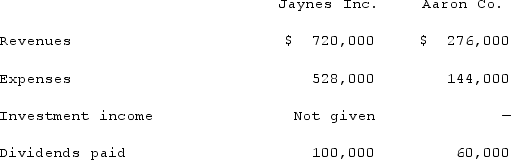

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

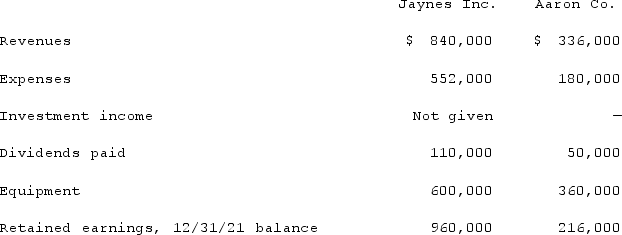

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What was consolidated net income for the year ended December 31, 2021?

What was consolidated net income for the year ended December 31, 2021?

Definitions:

Resource

An asset or material that can be used to produce goods or services and achieve economic goals.

Produced

Refers to goods or services that have been manufactured, created, or brought forth through a combination of resources and labor.

Purely Competitive Market

A market structure characterized by a large number of buyers and sellers, homogeneous products, and no single buyer or seller having any control over the market price.

Product Price

The sum of money needed to buy a specific product or service.

Q17: In a transaction accounted for using the

Q49: Renz Co. acquired 80% of the voting

Q62: Under the equity method of accounting for

Q65: Parent Corporation acquired some of its subsidiary's

Q66: On January 1, 2021, Nichols Company acquired

Q66: On October 31, 2020, Darling Company negotiated

Q68: On January 1, 2021, the partners of

Q69: Pell Company acquires 80% of Demers Company

Q71: Stiller Company, an 80% owned subsidiary of

Q87: Presented below are the financial balances for