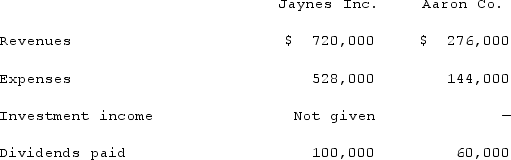

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

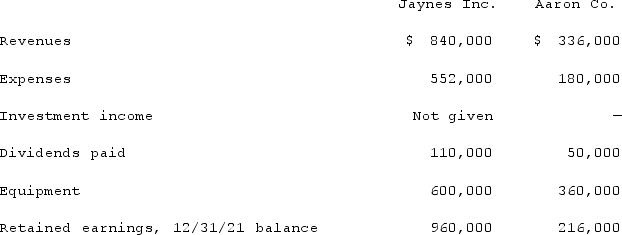

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What was the total for consolidated patents as of December 31, 2021?

What was the total for consolidated patents as of December 31, 2021?

Definitions:

Categorical

Pertaining to data or variables that represent categories, qualities, or characteristics without inherent numerical value.

Nominal

Refers to data that can be categorized into named groups that do not imply any rank or order among them.

Nominal

A term describing a scale of measurement where numbers serve as labels for identification or classification, without any quantitative value.

Ordinal

Relating to a category of data measurement levels that reflects the order of the values, but not the difference between them.

Q11: McGuire Company acquired 90 percent of Hogan

Q18: Jones, Marge, and Tate LLP decided to

Q20: Macklin Co. owned 70% of Holland Corp.

Q31: What happens when a U.S. company sells

Q38: What information is required in the financial

Q45: The partnership of Rayne, Marin, and Fulton

Q52: Parsons Company acquired 90% of Roxy Company

Q98: Using the acquisition method for a business

Q110: During 2021, Parent Corporation purchased at carrying

Q119: Key Company has had bonds payable of