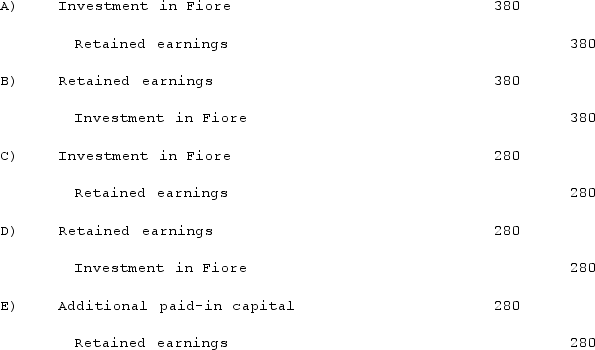

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the initial value method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

Definitions:

Q19: Pell Company acquires 80% of Demers Company

Q24: What account is debited in the general

Q30: On January 3, 2021, Roberts Company purchased

Q32: Hardin, Sutton, and Williams have operated a

Q34: On January 1, 2021, Harrison Corporation spent

Q41: Presented below are the financial balances for

Q48: Pell Company acquires 80% of Demers Company

Q71: When should property taxes be recognized under

Q87: On April 1, 2020, Shannon Company, a

Q91: In a step acquisition, which of the