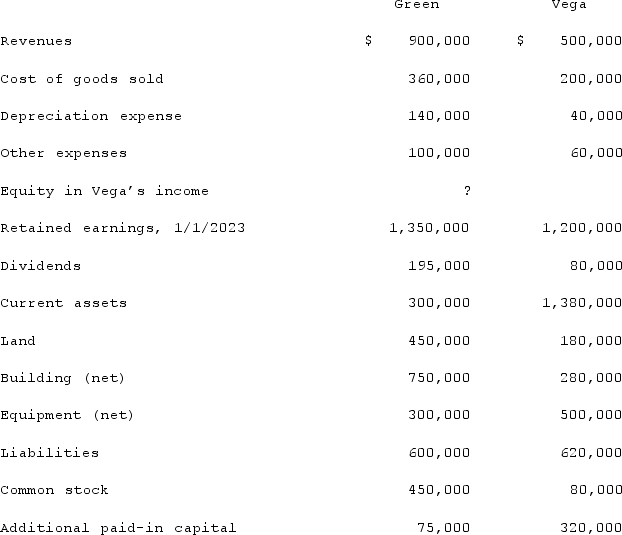

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Definitions:

Comprehensive Interview

An extensive and detailed interview process aimed at gathering a wide range of information, often used in research, clinical assessments, or job application processes.

Assessment Data

Information gathered through evaluation processes used to make informed decisions regarding patient care.

Critical-Thinking Model

A framework designed to promote reflective thinking or reasoned thought processes to solve problems or make decisions.

Pathophysiology

The study of the functional changes that occur in the body as a result of an injury, disorder, or disease.

Q19: Which of the following internal record-keeping methods

Q28: Which information must be disclosed regarding tax

Q49: Acquired in-process research and development is considered

Q49: On January 3, 2020, Baxter, Inc. acquired

Q59: Jackson Company acquires 100% of the stock

Q63: Scott Co. paid $2,800,000 to acquire all

Q66: Patti Company owns 80% of the common

Q82: Pell Company acquires 80% of Demers Company

Q96: Johnson, Inc. owns control over Kaspar, Inc.

Q110: When a parent company acquires a less-than-100