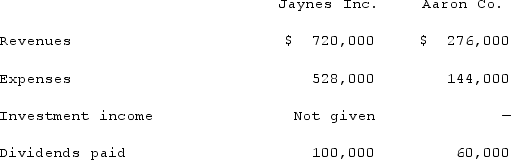

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

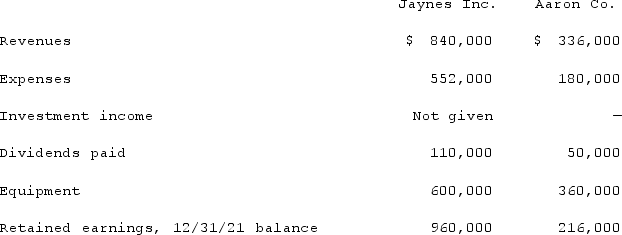

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What was consolidated net income for the year ended December 31, 2021?

What was consolidated net income for the year ended December 31, 2021?

Definitions:

Criminal Law

A branch of law that deals with crimes and their punishments, including the definition of criminal offenses and the imposition of sanctions such as fines and imprisonment.

Cause of Action

A set of facts sufficient to justify the right to sue to obtain money, property, or the enforcement of a right against another party.

Other Province

Refers to a region or administrative division within a country that is distinct from the one being referred to or considered.

Victim(Action)

Engaging in activities or steps to address the harm or injustice experienced by individuals or entities considered victims.

Q11: When a city collects admission fees from

Q14: Which of the following would be considered

Q24: Acker Inc. bought 40% of Howell Co.

Q27: A city starts a solid waste landfill

Q28: Which information must be disclosed regarding tax

Q43: How do intra-entity transfers of inventory affect

Q46: Walsh Company sells inventory to its subsidiary,

Q72: Potter Corp. (a U.S. company in Colorado)had

Q74: A $6,000,000 bond is issued by Kensington

Q89: On October 1, 2021, Jarvis Co. sold