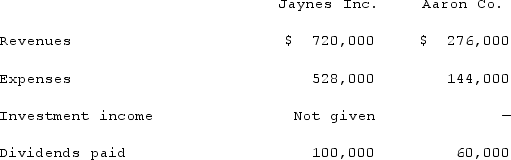

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

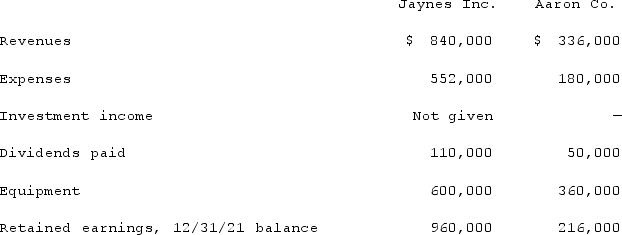

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What was the total for consolidated patents as of December 31, 2021?

What was the total for consolidated patents as of December 31, 2021?

Definitions:

Direct Marketing

A type of advertising that allows businesses to communicate directly with customers through various mediums, including emails, mailers, and phone calls.

Global Market

An international marketplace where goods, services, currencies, and information are exchanged across national borders.

Payment Methods

Various ways in which transactions can be settled, including cash, credit cards, checks, and digital payments.

Government Regulations

Rules or laws established by the government to control or direct the actions of individuals, businesses, or other entities within a society.

Q7: The following information has been taken from

Q27: An investor should always use the equity

Q38: What information is required in the financial

Q39: What are the primary sources of information

Q53: On January 1, 2021, Anderson Company purchased

Q54: On January 1, 2021, Pride, Inc. acquired

Q54: Pell Company acquires 80% of Demers Company

Q59: Charleston Inc. acquired 75% of Savannah Manufacturing

Q69: A local partnership was considering the possibility

Q82: On January 3, 2020, Trycker, Inc. acquired