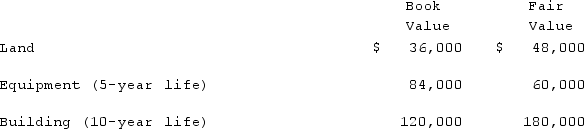

Utah Inc. acquired all of the outstanding common stock of Trimmer Corp. on January 1, 2019. At that date, Trimmer owned only three assets and had no liabilities:

If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

Definitions:

Quick Response Systems

Technologies or methodologies focusing on reducing lead times and enhancing efficiency in operations, often in a supply chain or manufacturing context.

Efficient Consumer Response Systems

A strategy used in the retail industry to improve the supply chain's responsiveness to consumer needs through better data sharing and management.

Order Replenishment Systems

Systems designed to manage and automate the process of restocking products or materials to meet customer demand without overstocking.

Self-discrepancy Theory

A theory suggesting that psychological distress and emotional discomfort arise from discrepancies between one's actual self, ideal self, and ought self.

Q6: The following information has been taken from

Q37: Panton, Inc. acquired 18,000 shares of Glotfelty

Q45: In governmental accounting, what term is used

Q52: Governmental funds are<br>A)Funds used to account for

Q60: Stark Company, a 90% owned subsidiary of

Q76: On January 1, 2021, Kenneth City purchased

Q88: Steven Company owns 40% of the outstanding

Q94: Stiller Company, an 80% owned subsidiary of

Q98: Using the acquisition method for a business

Q122: The knowledge, expertise, or skill that underlies