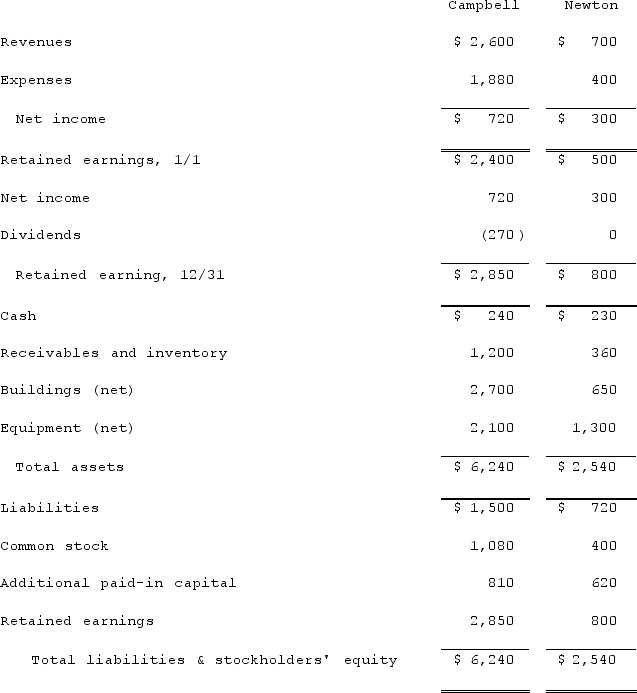

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Assuming that Newton retains a separate corporate existence after this acquisition, at what amount is the investment recorded on Campbell's books?

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Assuming that Newton retains a separate corporate existence after this acquisition, at what amount is the investment recorded on Campbell's books?

Definitions:

DDT

Dichloro-Diphenyl-Trichloroethane, a synthetic insecticide used historically for malaria and pest control, now banned in many countries due to environmental impact.

Nitrogen Cycle

A biogeochemical cycle that describes the transformations of nitrogen and nitrogen-containing compounds in nature.

Nitrogen Fixation

The process by which nitrogen gas from the atmosphere is converted into ammonia by certain bacteria, making nitrogen available to living organisms.

Denitrification

A microbial process occurring mostly in soil and aquatic environments, where nitrate is reduced and ultimately produces molecular nitrogen, removing it from the ecosystem.

Q4: The Allen, Bevell, and Carter partnership began

Q10: Following are selected accounts for Green Corporation

Q13: The Town of Harvest opened a solid

Q20: A local partnership was in the process

Q66: How is contingent consideration accounted for in

Q77: Prater Inc. owned 85% of the voting

Q103: How does the parent's choice of investment

Q110: During 2021, Parent Corporation purchased at carrying

Q116: Malone Co. owned 70% of Bernard Corp.'s

Q121: Which one of the following varies between