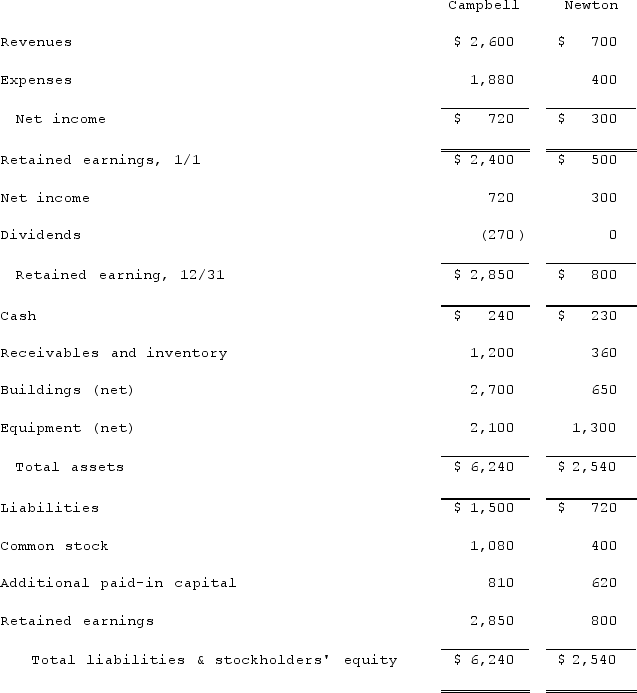

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.What total amount of additional paid-in capital will Campbell recognize from this acquisition?

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.What total amount of additional paid-in capital will Campbell recognize from this acquisition?

Definitions:

Motivations

The reasons or forces that drive individuals to take certain actions or behave in specific ways.

Structural Functionalism

A sociological perspective that interprets society as a structure with interrelated parts designed to meet the biological and social needs of individuals that make up that society.

Talcott Parsons

An American sociologist known for his contributions to the field of sociology, including the development of the action theory and the system theory.

Robert K. Merton

An American sociologist known for developing theories such as the self-fulfilling prophecy, strain theory, and the roles of social structure in scientific knowledge.

Q5: Stark Company, a 90% owned subsidiary of

Q18: On January 4, 2020, Nelson Corporation purchased

Q18: On January 1, 2019, Palk Corp. and

Q31: Panton, Inc. acquired 18,000 shares of Glotfelty

Q31: When Valley Co. acquired 80% of the

Q37: Renz Co. acquired 80% of the voting

Q54: The recession that began in 2008 forced

Q56: Brady, Inc., a calendar-year corporation, acquires 75%

Q70: Under the initial value method, the parent

Q104: The financial statements for Campbell, Inc., and