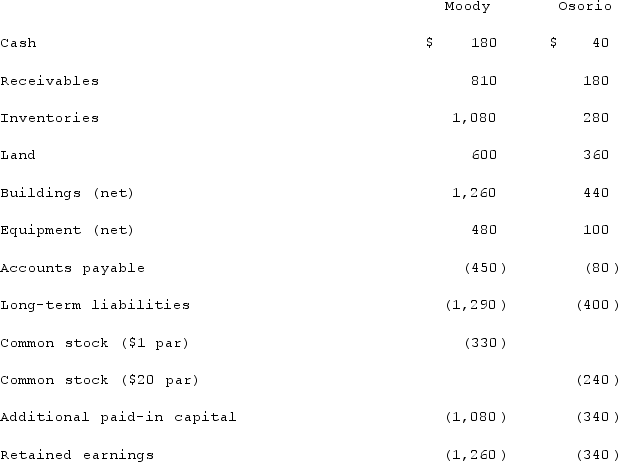

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.If Osorio retains a separate corporate existence, what amount was recorded as the investment in Osorio?

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.If Osorio retains a separate corporate existence, what amount was recorded as the investment in Osorio?

Definitions:

Sales Returns

Goods returned to the seller by the buyer after the sale, leading to a reduction in sales revenue.

Discount Period

The timeframe within which a buyer can make payment less a discount for early settlement, encouraging quicker payment from customers.

Operating Expense Section

A part of the income statement that lists expenses related to the day-to-day operations of a business, excluding the cost of goods sold.

Wholesaler

An intermediary entity in the distribution channel that buys goods in bulk from manufacturers and sells them to retailers or other businesses, but not directly to consumers.

Q13: Why do intra-entity transfers between the component

Q14: The City of Athens operates a motor

Q34: On January 1, 2021, Harrison Corporation spent

Q34: Consolidated net income using the equity method

Q44: Pell Company acquires 80% of Demers Company

Q50: Flynn acquires 100 percent of the outstanding

Q56: On January 1, 2020, Archer, Incorporated, paid

Q67: A parent company owns a controlling interest

Q89: On January 1, 2020, Smeder Company, an

Q103: How does the parent's choice of investment