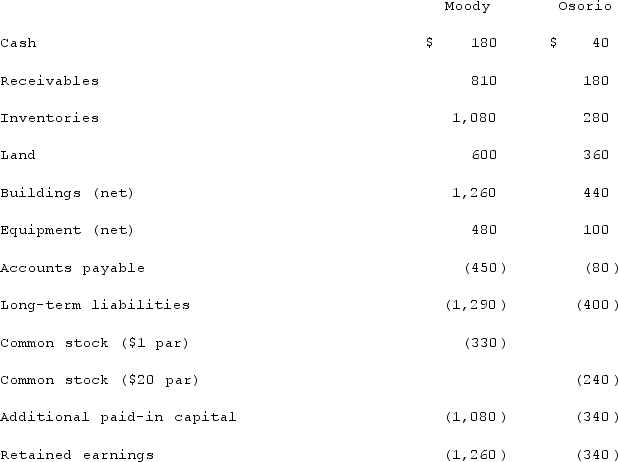

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

Definitions:

Demand

The volume of goods or services that consumers can and want to buy across a range of prices within a certain period.

Price Elasticity

A metric indicating the responsiveness of the quantity of a good demanded to its price change, presented in percentage terms.

Demand

In economics, the desire and ability of consumers to purchase goods and services at given prices.

Revenue Maximizing Price

The price at which a company can sell its product or service to generate the maximum total revenue, considering factors like demand and price elasticity.

Q12: On January 1, 2020, Mehan, Incorporated purchased

Q22: The partners of Donald, Chief & Berry

Q23: How is the gain on an intra-entity

Q41: Among the support activities in the generic

Q52: On January 1, 2019, Rand Corp. issued

Q55: Organic firms are _ changing competitive demands.<br>A)faster

Q56: Brady, Inc., a calendar-year corporation, acquires 75%

Q65: Which of the following methods is not

Q66: How is contingent consideration accounted for in

Q69: On January 1, 2020, Barber Corp. paid