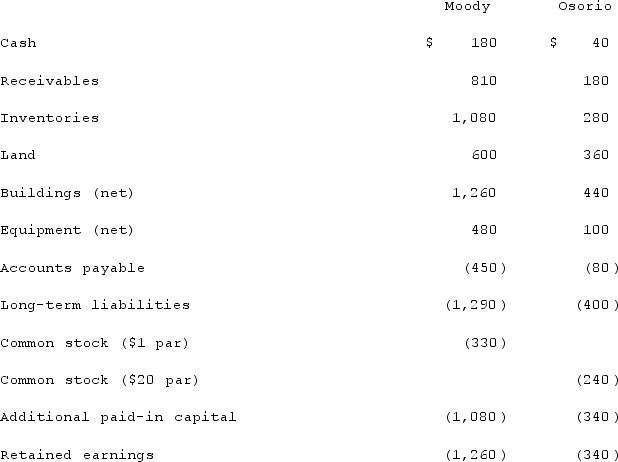

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

Motor-Control Information

Data or inputs relevant to the regulation of movements and actions of muscles or groups of muscles in the body.

Sympathetic Nervous

The sympathetic nervous system is part of the autonomic nervous system that prepares the body for physical activity and response to stress, fear, or emergency by triggering the fight or flight response.

Parasympathetic Nervous

Part of the autonomic nervous system responsible for conserving energy and slowing the heart rate, often referred to as the "rest and digest" system.

Autonomic Nervous

Refers to the part of the nervous system that controls involuntary actions of the body's glands, muscles of the internal organs, and blood vessels, including the heart.

Q32: Stark Company, a 90% owned subsidiary of

Q37: Panton, Inc. acquired 18,000 shares of Glotfelty

Q40: What are the two proprietary fund types?(1)Internal

Q41: Which statement is false regarding the Balance

Q64: Harrison, Inc. acquires 100% of the voting

Q73: When a company has preferred stock in

Q82: On January 3, 2020, Trycker, Inc. acquired

Q84: What are the five types of governmental

Q92: Milton Co. owned all of the voting

Q93: On January 1, 2021, Lee Company paid