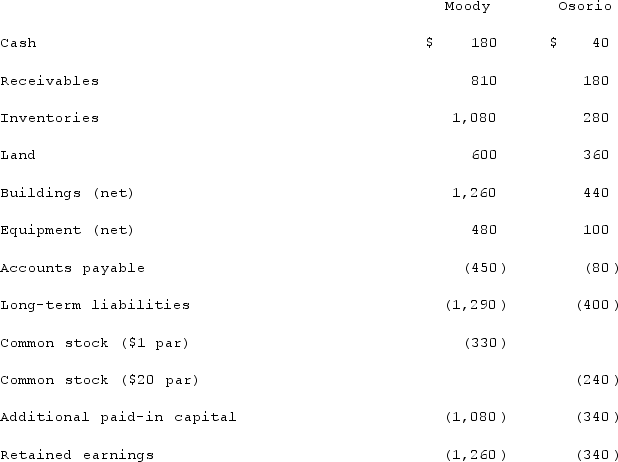

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated land at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated land at date of acquisition.

Definitions:

Lower Income Strata

A demographic group that earns significantly less income than the average, often facing economic challenges and reduced access to resources.

Trivial Matters

Issues or subjects that are of little importance or significance.

Stalking

Persistent and unwanted attention by one individual towards another, leading to fear or distress.

Counteract

To act against something to reduce its force or neutralize its effects.

Q6: The following account balances were available for

Q45: Which criteria must be met to be

Q47: How do outstanding subsidiary stock warrants affect

Q49: What are the four fiduciary fund types?

Q50: Dunne Inc. bought 65% of the outstanding

Q65: In flexible factories, scheduling decisions are made

Q69: Walsh Company sells inventory to its subsidiary,

Q86: The top management team at Universal Manufacturing

Q89: LaFevor Co. acquired 70% of the common

Q122: On January 1, 2020, Mehan, Incorporated purchased