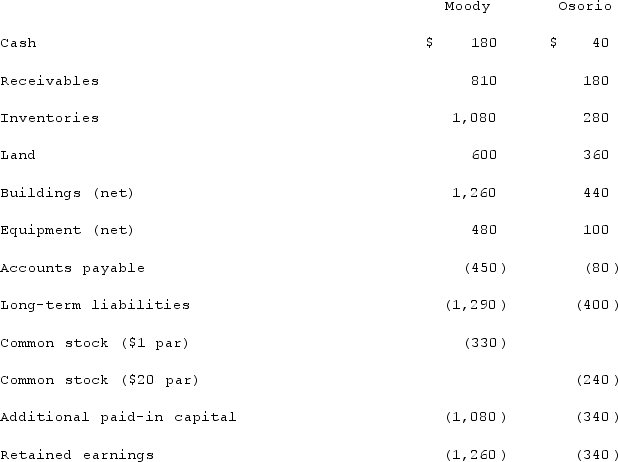

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated equipment at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated equipment at date of acquisition.

Definitions:

Prenatal Care

Healthcare that a pregnant woman receives before the birth of her baby, aimed at ensuring a healthy pregnancy and delivery.

Cultural Support

The assistance and encouragement provided by a community or society that shares the same customs, beliefs, and traditions.

Vernix Caseosa

Greasy material that protects the fetal skin from abrasions, chapping, and hardening that can occur from exposure to amniotic fluid.

Fetal Skin

Refers to the skin of a fetus, which undergoes significant development and changes throughout pregnancy.

Q4: How do intra-activity and interactivity transactions differ

Q8: On December 31, 2020, the City of

Q16: On January 4, 2021, Colton Corp. acquired

Q22: Which item is not included on the

Q30: On January 3, 2021, Roberts Company purchased

Q32: When a parent company acquires a less-than-100

Q40: Presented below are the financial balances for

Q42: When consolidating parent and subsidiary financial statements,

Q50: All of the following are true about

Q95: For each of the following situations, select