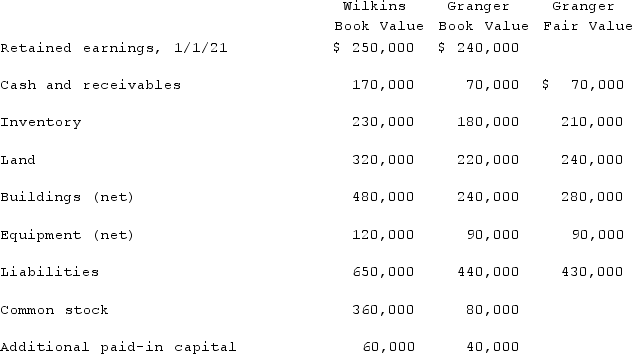

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins issued 13,000 shares of common stock with a $5 par value and a $46 fair value for all of the outstanding stock of Granger. What is the consolidated balance for Land as a result of this acquisition transaction?

Assume that Wilkins issued 13,000 shares of common stock with a $5 par value and a $46 fair value for all of the outstanding stock of Granger. What is the consolidated balance for Land as a result of this acquisition transaction?

Definitions:

Direct Competitors

Businesses offering the exact or highly similar products or services as another business in the same market.

Indirect Competitors

Companies that offer slightly different products or services but compete for the same customer dollars due to overlapping needs or desires.

Competition Section

A segment within a business plan or report that analyzes the competitive landscape, detailing the strengths and weaknesses of competitors within the market.

Larger Market Share

The portion of a market controlled by a particular company or product, with a larger extent signifying dominance or a significant competitive advantage.

Q11: Walsh Company sells inventory to its subsidiary,

Q43: Which of the following is true regarding

Q46: According to the GASB (Governmental Accounting Standards

Q52: It is a challenge for companies to

Q65: As of January 1, 2021, the partnership

Q98: Dodd Co. acquired 75% of the common

Q103: After allocating cost in excess of book

Q109: Steven Company owns 40% of the outstanding

Q116: Fesler Inc. acquired all of the outstanding

Q121: Stark Company, a 90% owned subsidiary of