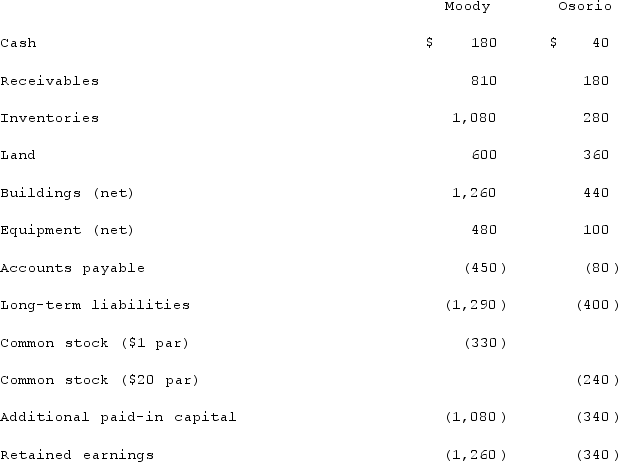

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.If Osorio retains a separate corporate existence, what amount was recorded as the investment in Osorio?

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.If Osorio retains a separate corporate existence, what amount was recorded as the investment in Osorio?

Definitions:

Territorial Space

Bands of concentric space radiating outward from the body.

Social Distance Zone

A concept in proxemics referring to the physical distance individuals prefer to maintain in social interactions to feel comfortable.

Personal Distance Zone

A spatial zone commonly reserved for interactions among good friends or family members, reflecting cultural or personal preferences for physical proximity.

Open Communication

A communication style that promotes transparency and free exchange of information and ideas in an organization or between individuals.

Q11: When a city collects admission fees from

Q23: How is the Statement of Cash Flows

Q36: Which of the following is a section

Q43: On January 1, 2020, Archer, Incorporated, paid

Q46: LaFevor Co. acquired 70% of the common

Q53: A parent company owns a controlling interest

Q74: Pell Company acquires 80% of Demers Company

Q76: A variable interest entity can take all

Q82: On January 3, 2020, Trycker, Inc. acquired

Q103: Ari told his boss, "Unless we invest