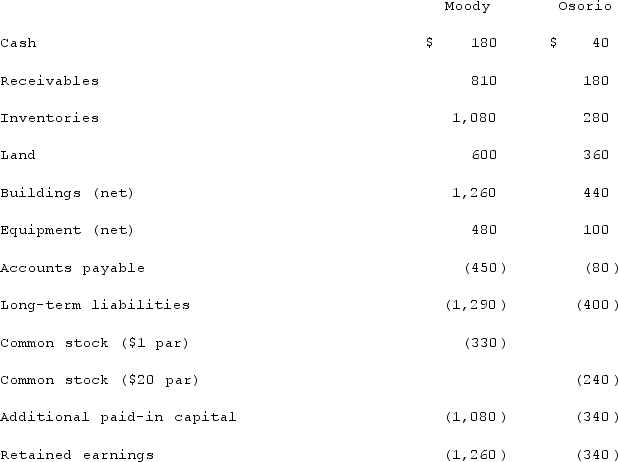

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

Definitions:

Neural Tissue

Specialized tissue that makes up the nervous system, including the brain, spinal cord, and nerves, responsible for transmitting signals throughout the body.

Eyeball

The spherical part of the eye that contains the optic nerve, retina, lens, and other structures, enabling vision.

Ganglion Cells

Neurons in the retina of the eye, which gather information from receptor cells (by way of intermediate bipolar cells); their axons make up the optic nerve.

Rods

Photoreceptor cells in the retina of the eye that are extremely sensitive to light and enable vision in low-light conditions.

Q5: Describe the accounting for direct costs, indirect

Q7: On January 1, 2021, Kapoor Co. sold

Q20: A local partnership was in the process

Q21: Vaughn Inc. acquired all of the outstanding

Q37: Renz Co. acquired 80% of the voting

Q38: The Marshall County legislature voted to set

Q58: Private companies, with respect to goodwill:<br>A)May elect

Q111: An ambidextrous organization should focus on exploration

Q113: Which of the following statements are true

Q113: A company has been using the equity