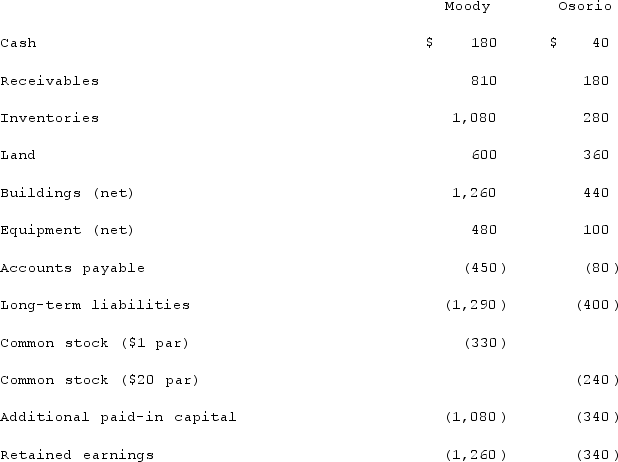

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated land at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated land at date of acquisition.

Definitions:

Issues of Fact

Matters in a legal case that are subject to dispute between parties and are to be determined through the presentation of evidence.

In Rem Jurisdiction

A legal concept referring to the court's power to adjudicate matters pertaining to property within its territory, regardless of the owner's location.

Jurisdiction

The official power to make legal decisions and judgments, often defined by geographic boundaries or types of legal cases.

Property

Legally recognized rights over the possession, use, and disposal of something tangible or intangible.

Q10: The financial statement amounts for the Atwood

Q16: Over the years, four alternatives have been

Q24: The partnership of Gordon, Handel, and Mitchell

Q26: A business combination results in $90,000 of

Q34: Yoderly Co., a wholly owned subsidiary of

Q39: Pell Company acquires 80% of Demers Company

Q42: Will Co. owned 80% of the voting

Q54: Watkins, Inc. acquires all of the outstanding

Q55: A company has been using the fair-value

Q101: MacDonald, Inc. owns 80% of the outstanding