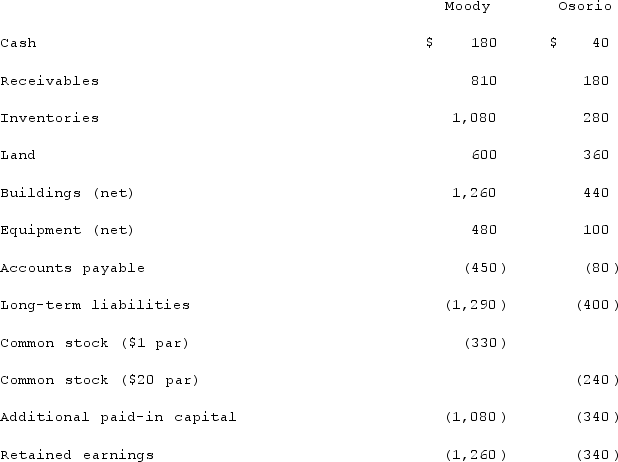

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated cash after recording the acquisition transaction.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated cash after recording the acquisition transaction.

Definitions:

Self-Contained

Referring to a system or entity that has all necessary components within itself to function independently.

Cash Management System

A framework used by companies and individuals to manage, monitor, and control their cash flow and liquidity efficiently.

Disbursement Float

The time delay between when a check is written and the funds are actually deducted from the payer's account.

Collections Float

The time gap between when a check is deposited in a bank and when the funds become available, affecting the cash flow of the business.

Q7: Large companies can typically lower costs per

Q13: LaFevor Co. acquired 70% of the common

Q16: Denise works as a quality-control inspector on

Q30: What are the two specific criteria essential

Q39: Pell Company acquires 80% of Demers Company

Q82: Which of the following is not a

Q90: Jackson Company acquires 100% of the stock

Q101: On January 1, 2021, Halpert Inc. acquired

Q106: How would a change be made from

Q117: Jones, Incorporated acquires 15% of Anderson Corporation