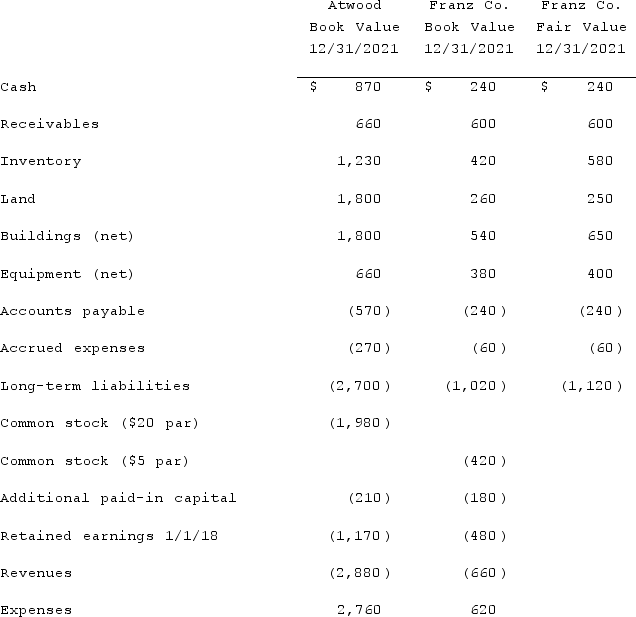

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute fair value of the net assets acquired at the date of the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute fair value of the net assets acquired at the date of the acquisition.

Definitions:

Q3: On January 3, 2020, Baxter, Inc. acquired

Q35: Caldwell Inc. acquired 65% of Club Corp.

Q48: Which of the following is not a

Q56: Brady, Inc., a calendar-year corporation, acquires 75%

Q72: Acker Inc. bought 40% of Howell Co.

Q79: Tosco Co. paid $540,000 for 80% of

Q87: Several years ago, Polar Inc. acquired an

Q96: Which of the following is not an

Q108: Elon Corp. obtained all of the common

Q117: According to the FASB ASC regarding the