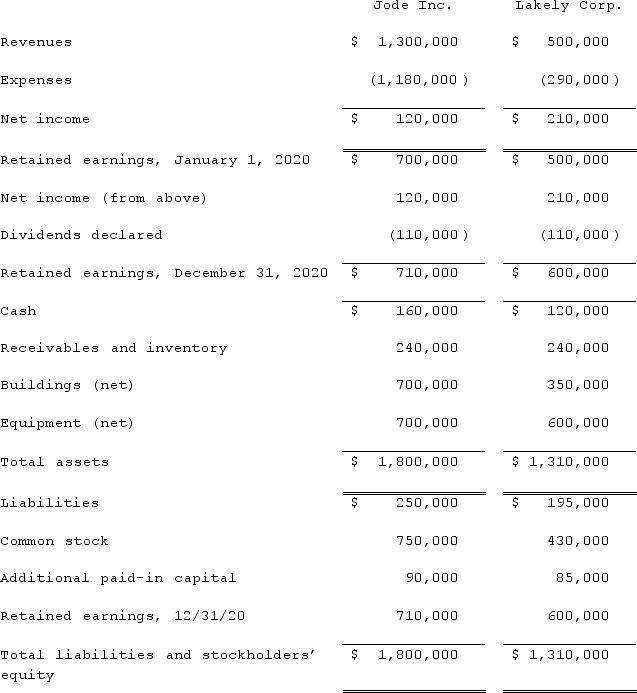

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2020, follow. Lakely's buildings were undervalued on its financial records by $60,000.

On December 31, 2020, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.Determine consolidated Additional Paid-In Capital at December 31, 2020.

On December 31, 2020, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.Determine consolidated Additional Paid-In Capital at December 31, 2020.

Definitions:

Absorption Costing

A bookkeeping approach that incorporates all production expenses such as direct materials, direct labor, and both variable and fixed overhead costs into the pricing of a product.

Variable Costing

An accounting method that considers only variable costs in product costing and decision-making, excluding fixed overhead expenses.

EBITDA

Stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, a measure of a company's overall financial performance.

Theme Park

A large outdoor area where entertainment is provided, typically through rides, games, and themed attractions.

Q11: Perfect quality, elimination of waste, value-added manufacturing,

Q34: The term "current financial resources" refers to<br>A)Those

Q40: Pepe, Incorporated acquired 60% of Devin Company

Q48: When a company applies the initial value

Q53: Jaynes Inc. acquired all of Aaron Co.'s

Q63: LaFevor Co. acquired 70% of the common

Q80: Pritchett Company recently acquired three businesses, recognizing

Q105: Jackson Company acquires 100% of the stock

Q117: A value chain is the sequence of

Q118: Hoyt Corporation agreed to the following terms