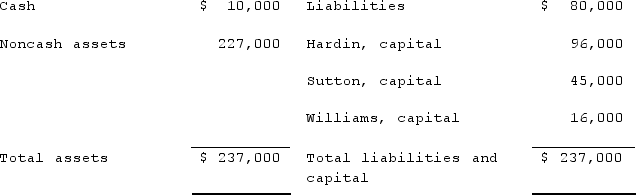

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Null Hypothesis

In hypothesis testing, it is the default hypothesis that there is no effect or no difference, and it is subject to test for possible rejection.

Cholesterol Levels

The amount of cholesterol present in the bloodstream, important for assessing heart disease risk.

Sign Test

A non-parametric test that assesses the median of a statistical population by comparing the number of positive vs. negative changes from a median value.

Matched Pairs

A study design where each participant is paired with another participant who has similar characteristics, but receives a different treatment.

Q3: What are the four steps established by

Q3: Which of the following statements is true

Q4: Baker Thompson, CEO of Unicorn Construction, announced

Q45: In governmental accounting, what term is used

Q50: In organizations that use continuous process technologies,<br>A)a

Q50: All of the following are true about

Q56: The financial statements for Campbell, Inc., and

Q61: Successfully fostering and managing intrapreneurship requires the

Q73: As operations manager for Osan Electronics, Jun

Q116: Fesler Inc. acquired all of the outstanding