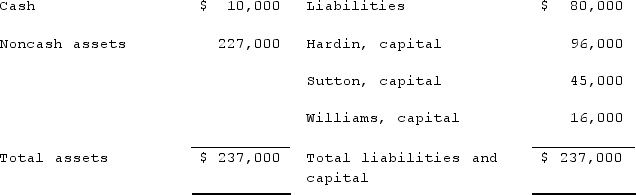

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

Definitions:

Coder

A professional responsible for converting medical diagnoses, treatments, procedures, and symptoms into codes using classification systems such as ICD-10-CM, HCPCS Level II, and CPT for billing and documentation purposes.

POA Assignments

The designation of whether a condition was present at the time of admission, used in healthcare documentation to indicate the onset of a diagnosis.

Codes

Systems of symbols or sequences used to represent information for various purposes, including data compression, cryptography, and identification.

MCC

Commonly refers to Merkel Cell Carcinoma, a rare and aggressive form of skin cancer, or can stand for Major Complications and Comorbidities in medical billing and coding.

Q9: Which of the following statements regarding Management's

Q12: Everyday Fashions Corp. is a clothing manufacturer.

Q27: Revenue from property taxes should be recorded

Q35: To be successful, partners in a strategic

Q36: The Keller, Long, and Mason partnership had

Q64: Manufacturers can improve logistics efficiency and speed

Q66: Gloria manages a large chemical plant that

Q66: How does the use of the equity

Q68: The financial statement amounts for the Atwood

Q91: In order to meet six sigma standards,