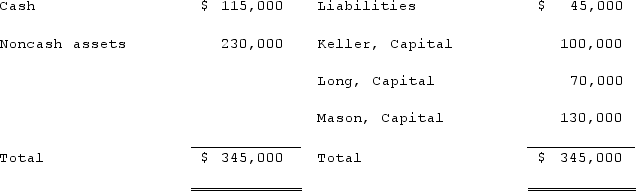

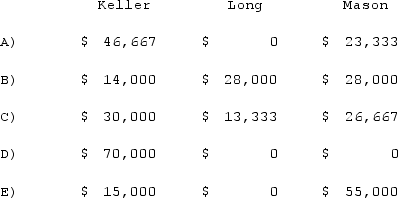

The Keller, Long, and Mason partnership had the following balance sheet just before entering liquidation:  Keller, Long, and Mason share profits and losses in a ratio of 2:4:4.The partnership feels confident it will be able to eventually sell the noncash assets and wants to distribute some cash before paying liabilities. Assuming there will be no liquidation expenses, how much would each partner receive of a total $70,000 distribution of cash?

Keller, Long, and Mason share profits and losses in a ratio of 2:4:4.The partnership feels confident it will be able to eventually sell the noncash assets and wants to distribute some cash before paying liabilities. Assuming there will be no liquidation expenses, how much would each partner receive of a total $70,000 distribution of cash?

Definitions:

Mutually Exclusive Projects

Projects in which the acceptance of one proposal means the others cannot be pursued, requiring a choice to be made.

Capital Budgeting Analyses

The process of evaluating investment opportunities and deciding which capital expenditures will provide the most value over time.

Delivery Truck

A vehicle specifically designed and used for transporting goods from one location to another, often utilized by businesses for logistical purposes.

Metal Stamping Press

A machine tool used in manufacturing to shape or cut metal by deforming it with a die.

Q4: Under the equity method, when the company's

Q7: On January 3, 2021, Madison Corp. purchased

Q29: As a manager working directly under the

Q33: A local partnership has assets of cash

Q35: Xygote, Yen, and Zen were partners who

Q52: Among the positions of the top managerial

Q65: As of January 1, 2021, the partnership

Q68: The first step to building organizational support

Q99: Large organizations are typically _ than small

Q122: The knowledge, expertise, or skill that underlies