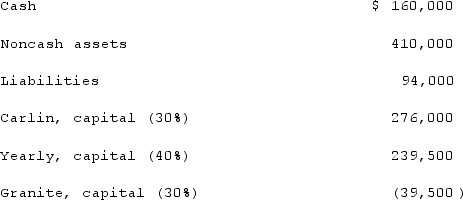

As of January 1, 2021, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses:

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

Definitions:

Dishonor

The failure to pay or accept a negotiable instrument that has been properly presented.

Notice

A formal declaration or warning of something, often used in legal contexts to inform parties of actions, requirements, or proceedings.

Surrender

The act of giving up something or yielding possession, often under duress or in compliance with a legal requirement.

Instrument

in legal and financial contexts, refers to a formal document, such as a contract, will, promissory note, or financial security.

Q26: The financial statements for Jode Inc. and

Q26: What is meant by the term fiscally

Q32: Katya is evaluating whether she has the

Q35: A disadvantage of a multinational model is

Q57: What are monetary transfers and how are

Q58: For five years, California-based ExPro Communications had

Q65: Louise and Cecile want to start an

Q85: On January 4, 2021, Mason Co. purchased

Q97: On January 1, 2021, Chester Inc. acquired

Q104: The financial statements for Campbell, Inc., and