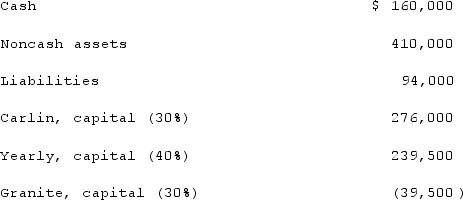

As of January 1, 2021, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses:

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.How much cash should each partner receive at this time, pursuant to a proposed schedule of liquidation?

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.How much cash should each partner receive at this time, pursuant to a proposed schedule of liquidation?

Definitions:

Legal Relationship

A connection between entities or individuals that is recognized and enforceable by law.

Radio

A radio is a technology that uses radio waves to transmit information, such as sound, by systematically modulating properties of electromagnetic energy waves transmitted through space.

Contract Formation

The process of creating a legally binding agreement, typically involving offer, acceptance, consideration, and mutual consent among parties.

Self-Service Merchandising

A retail strategy where customers select products by themselves without direct assistance from staff, typically in grocery or department stores.

Q7: A local partnership was considering the possibility

Q27: An investor should always use the equity

Q49: Which of the following has been an

Q53: Under modified accrual accounting, when should revenues

Q59: Which of the following is an effective

Q70: Annual budgets must be recorded within:<br>A)The general

Q71: Everyday Fashions Corp. is a clothing manufacturer.

Q93: Chang works as a materials scientist for

Q103: _ create strong pressure for a global

Q106: How would a change be made from