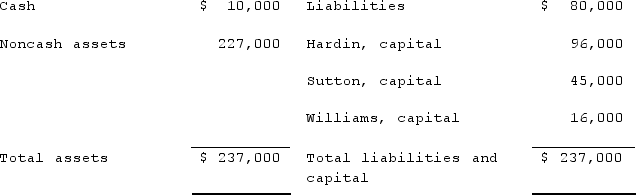

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Control Theory

A theory in psychology and sociology that examines how external rules, regulations, and feedback mechanisms influence behavior and social order.

Physical Survival Needs

Basic necessities required for human survival, including food, water, shelter, and clothing.

Glasser

Refers to William Glasser, an American psychiatrist who developed the theories of Reality Therapy and Choice Theory.

Authentic

Being genuine or true to one's self, values, and beliefs in one's actions and interactions.

Q26: On June 14, 2021, Carbondale City agreed

Q33: The financial statements for Campbell, Inc., and

Q46: Discuss ways in which companies can be

Q63: Collaborating with other countries in trade<br>A)leads to

Q74: How should an investor account for, and

Q79: The City of Grisham collected $19,000 from

Q81: What is the primary difference between recording

Q85: Which of the following is a reason

Q88: What should an entity evaluate when making

Q88: What is the purpose of Consolidation Entry