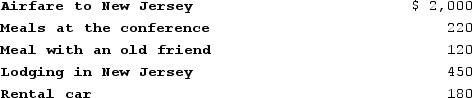

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey. After Shelley attended the conference, she had dinner with an old friend who lived nearby. Shelley documented her expenditures (described below) . What amount can Shelley deduct?

Definitions:

Grave Disability

A condition in which a person, due to a mental disorder, is unable to provide for their basic personal needs for food, clothing, or shelter.

Dangerousness to Self

This refers to a person's potential to cause harm to themselves, often considered in mental health assessments for risk of suicide or self-harm.

Unconstitutionality

The state of being in violation of a constitution, especially pertaining to laws, regulations, or government actions.

O'Connor v. Donaldson

A landmark legal case in which the U.S. Supreme Court ruled that a state cannot constitutionally confine a non-dangerous individual capable of surviving safely in freedom by themselves or with the help of willing and responsible family members or friends.

Q4: Patient HM developed deficits for episodic long-term

Q9: Which of the following business expense deductions

Q12: Jocelyn, a single taxpayer, had $742,000 of

Q15: When participants are not warned in advance

Q20: Sarantuya, a college student, feels that now

Q21: The correct ordering of the words used

Q99: Constructive receipt represents the principle that cash-basis

Q109: Linda is a qualifying widow in 2020.

Q127: In 2020, Shawn's adjusted gross income (AGI)is

Q156: All else equal, a reduction in regular