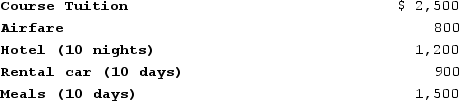

Sam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year, Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip:

What amount of travel expenditures can Sam deduct?

What amount of travel expenditures can Sam deduct?

Definitions:

Derivatives Markets

Markets where financial instruments, whose value is derived from other assets, are traded. These include futures, options, and swaps.

Transferring Risk

Shifting potential financial loss to another party through mechanisms like insurance, hedging, or outsourcing, to manage vulnerability to risk.

Investing

The process of distributing funds or resources with the aim of earning a return or profit.

Interest Income

Income earned from deposit accounts or investments that pay interest, such as bonds and savings accounts.

Q1: Tamra and Jacob are married and they

Q9: What is the Percentage Rate of Return

Q45: When taxpayers donate cash and capital gain

Q76: Which of the following best describes the

Q89: When a carpenter provides $100 of services

Q89: For married taxpayers filing separately, excess business

Q91: Miley, a single taxpayer, plans on reporting

Q116: Montague (age 15)is claimed as a dependent

Q125: This year Mary received a $340 refund

Q168: Trudy is Jocelyn's friend. Trudy looks after