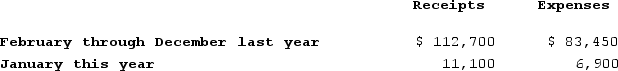

David purchased a deli shop on February 1st of last year and began to operate it as a sole proprietorship. David reports his personal taxes using the cash method over a calendar year, and he wants to use the cash method and fiscal year for his sole proprietorship. He has summarized his receipts and expenses through January 31st of this year as follows:

What income should David report from his sole proprietorship?

What income should David report from his sole proprietorship?

Definitions:

Job Order Cost Accounting

An accounting method that accumulates and assigns costs to specific products or projects based on individual job orders.

Equivalent Units

A concept used in cost accounting to convert partially completed goods into a number of complete units of output.

Work in Process Inventory

Represents goods that are in the production process but are not yet completed.

Conversion Cost

The sum of direct labor and manufacturing overhead costs, representing the expenses necessary to convert raw materials into finished goods.

Q1: Kaylee is a self-employed investment counselor who

Q4: If you put $50 in a savings

Q5: A lower discount rate tends to lead

Q7: The basic categories of job skills in

Q8: Cory recently sold his qualified small business

Q10: In Figure 2-24, if a good is

Q17: The three subcategories of implicit memory presented

Q35: Colby Motors uses the accrual method and

Q63: When a bond is purchased in the

Q82: Montague (age 15)is claimed as a dependent