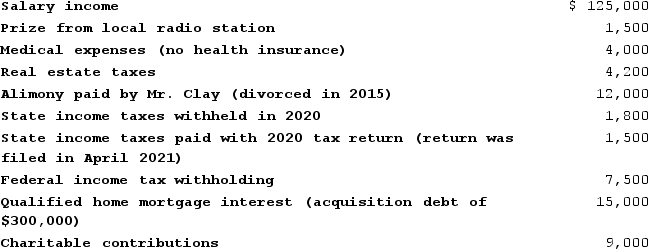

During all of 2020, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2020. Neither is blind, and both are under age 65. They reported the following tax-related information for the year. (Use the tax rate schedules, 2020 Alternative minimum tax (AMT)exemption)

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Financial Losses

The reduction in monetary value or resources, typically resulting from investments, business operations, or unforeseen circumstances.

Premium

A promotional item that is given as an incentive for performing a particular act, typically buying a product.

Incentive

A benefit, reward, or cost designed to motivate an individual or group to act in a desired way.

Internet Advertising

The practice of using the internet to promote products or services to consumers through various online platforms and channels.

Q6: The most common method of estimating the

Q9: Which of the following business expense deductions

Q52: Loretta received $6,200 from a disability insurance

Q54: Due to the alternative minimum tax rate

Q55: Long-term capital gains (depending on type)for individual

Q64: Investment interest expense is a for AGI

Q82: This year Barney purchased 500 shares of

Q97: Which of the following statements about a

Q106: Which of the following is not true

Q121: Robert will be working overseas on a