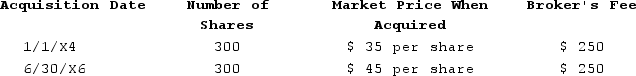

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase). (Do not round intermediate calculations.)

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Spreadsheet Method

A method of financial analysis or budgeting that uses a spreadsheet software to organize, calculate, and present data.

Noncash Accounts

Noncash accounts are financial accounts that track transactions not involving physical cash, such as depreciation, accruals, and allowances for doubtful accounts.

Purchase of Equipment

The acquisition of physical assets or machinery intended for use in production or operational processes.

Indirect Method

A way of preparing the cash flow statement where net income is adjusted for non-cash transactions, deferred amounts, and changes in working capital.

Q3: Interest earned on a city of Denver

Q9: The receipt of prizes and awards is

Q23: Fran purchased an annuity that provides $10,200

Q37: Larry recorded the following donations this year:

Q41: The capital gains (losses)netting process for taxpayers

Q51: Jamison's gross tax liability is $9,750. Jamison

Q62: The computation of the alternative minimum tax

Q98: John and Sally pay Janet (Sally's older

Q117: Which of the following is a true

Q163: Which of the following statements concerning a