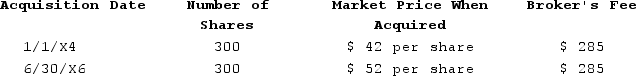

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $57 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase). (Round your intermediate calculations to 2 decimal places)

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Multiple Organ Failures

A critical condition where two or more systems in the body fail simultaneously, often as a result of severe illness or injury.

Body Dysmorphic Disorder

A mental health disorder involving obsessive focus on a perceived flaw in appearance, often leading to significant distress and impairment in daily functioning.

Acute Stress Disorder

A mental condition that develops shortly after exposure to a traumatic event, characterized by symptoms such as distress, avoidance, and flashbacks.

Dissociative Identity Disorder

A psychological condition where a person exhibits two or more distinct and alternating personalities.

Q5: According to Sen and Williams the principles

Q7: Brandon and Jane Forte file a joint

Q22: Henry and Janice are married and file

Q59: In the current year, Norris, an individual,

Q60: The tax law defines alimony to include

Q66: Janine's employer loaned her $5,000 this year

Q92: The lifetime learning credit can be used

Q109: Rolando's employer pays year-end bonuses each year

Q118: Filing status determines all of the following

Q157: For taxpayers who receive both salary as