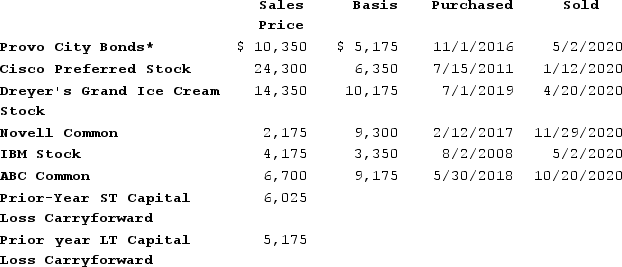

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City.

*Purchased when originally issued by Provo City.

What is the net short-term capital gain/loss reported on the 2020 Schedule D? What is the net long-term capital gain/loss reported on the 2020 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Definitions:

Theories of Motivation

Various concepts and models that explain what drives individuals to initiate, direct, and sustain behaviors to achieve personal or organizational goals.

Physiological

Relating to the branch of biology that deals with the normal functions of living organisms and their parts.

Psychological Deficiencies

Shortfalls in mental processes or cognitive functions, impacting an individual's behavior and capabilities.

Persistence

The quality of continuing steadfastly in a course of action in spite of difficulties, obstacles, or discouragement.

Q3: Which of the following is definitely not

Q4: Input-Output Models….<br>A)assume that each industry's output is

Q4: Jasmine and her husband, Arty, have been

Q9: The receipt of prizes and awards is

Q37: Investment income includes:<br>A)interest income.<br>B)net short-term capital gains.<br>C)nonqualified

Q43: Anna is a qualifying child of her

Q43: Which of the following statements regarding the

Q57: This year, Benjamin Hassell paid $20,000 of

Q115: Danny owns an electronics outlet in Dallas.

Q117: Which of the following is a true