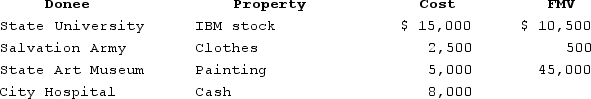

In 2020, Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Definitions:

Plating Copper

A process used to coat a surface with a thin layer of copper, often for improving electrical conductivity or for aesthetic purposes.

Poisonous Solid

A solid substance that is harmful or lethal to living organisms when ingested, inhaled, or absorbed.

Copper Electroplating

A process of coating objects with a thin layer of copper by using an electric current to reduce dissolved copper ions onto an electrically conductive surface.

Copper Sulfate

A chemical compound formed by combining copper, sulfur, and oxygen (CuSO4).

Q5: Which of the following does not affect

Q7: Brandon and Jane Forte file a joint

Q9: Qualified dividends are always taxed at a

Q33: Assume that Larry's marginal tax rate is

Q64: Which of the following has the lowest

Q65: Aubrey and Justin file married filing separately.

Q89: Akiko and Hitachi (married filing jointly for

Q91: The value of a tax deduction is

Q120: A taxpayer paying his 10-year-old daughter $50,000

Q151: Bernie is a former executive who is