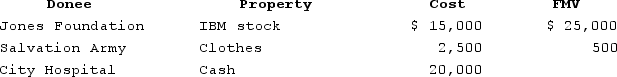

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Definitions:

Contra-Asset Account

An account shown on the balance sheet that reduces the value of a related asset, used for accumulated depreciation or allowances for doubtful accounts.

Depreciation Schedule

A table detailing the periodic depreciation expense of an asset over its useful life.

Worksheet

A document that accountants use for planning and preparing adjustments, showing the results of those adjustments before preparing financial statements.

Worksheet

A document used by accountants to gather information for adjusting entries and to prepare financial statements.

Q4: Rodney, a cash-basis taxpayer, owes $72,500 in

Q52: The timing strategy becomes more attractive if

Q52: The investment interest expense deduction is limited

Q74: Sullivan's wife, Susan, died four years ago.

Q80: Bob Brain files a single tax return

Q86: In February of 2019, Lorna and Kirk

Q109: Rolando's employer pays year-end bonuses each year

Q127: An individual may never be considered as

Q129: During all of 2020, Mr. and Mrs.

Q149: This year Kelsi received a $1,900 refund