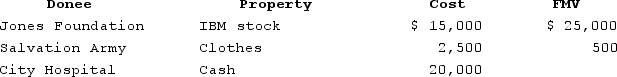

In 2020, Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Definitions:

Intra-entity

Pertains to transactions or activities occurring within the same legal entity.

Equity Method

An accounting technique used by a company to record its investment in another company based on the profit or loss and changes in the investee’s equity.

Significant Influence

A level of control exerted by an investor over an investee, characterized by the power to participate in financial and operating policy decisions without having full control or majority ownership.

Book Value

The net value of a company's assets minus its liabilities, reported on the balance sheet. It represents the shareholders' equity in the company.

Q3: Max, a single taxpayer, has a $270,000

Q4: Unemployment benefits are excluded from gross income.

Q15: In June of Year 1, Edgar's wife,

Q20: Sarantuya, a college student, feels that now

Q61: An acquiescence indicates that the IRS lost

Q68: A taxpayer is not permitted to use

Q92: Opal fell on the ice and injured

Q93: Employees are not allowed to deduct FICA

Q116: For purposes ofdetermining filing status, which of

Q139: The tax rate schedules are set up