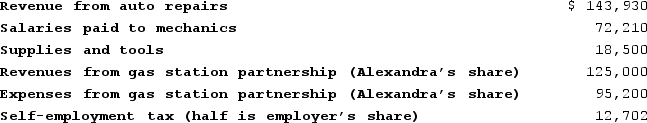

Alexandra operates a garage as a sole proprietorship. Alexandra also owns a half interest in a partnership that operates a gas station. This year Alexandra paid or reported the following expenses related to her garage and other property. Determine Alexandra's AGI for 2020.

Definitions:

Nonmaleficence

A principle in ethics, especially in healthcare, which dictates avoiding the causation of harm to others.

Intentional Harm

Refers to damage or negative effects deliberately inflicted on a person or group.

Delayed-Treatment Groups

A research method in which one group receives an intervention at a later time than another group, allowing for comparisons of outcomes.

Research Assistants

Individuals who provide support in conducting research tasks, such as data collection and analysis, under the direction of a principal investigator.

Q19: Which of the following statements regarding tax

Q19: Harmony reports a regular tax liability of

Q23: Investment interest expense does not include:<br>A)interest expense

Q78: What is the tax treatment for qualified

Q85: In general, tax planners prefer to defer

Q94: Caroline is retired and receives income from

Q113: Colbert operates a catering service on the

Q117: Dave is a plumber who uses the

Q129: Reasonable in amount means that expenditures can

Q145: The all-inclusive definition of income means that