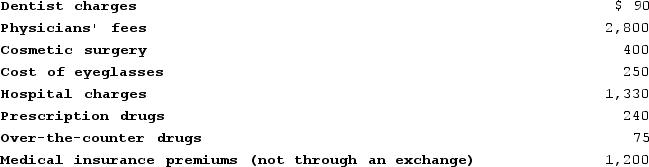

Jenna (age 50)files single and reports AGI of $40,000. This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Definitions:

Tangible Assets

Physical assets that can be touched or seen, such as machinery, buildings, vehicles, and inventory, which have a value and are owned by a business.

Escrow Settlement

A financial arrangement where a third party temporarily holds and regulates payment of the funds required for two parties involved in a given transaction.

Accountant

A professional responsible for managing and examining financial records and ensuring accuracy and compliance with laws.

Buyer And Seller

Individuals or entities involved in the transaction of goods or services, where the buyer acquires these from the seller in exchange for money.

Q12: Michelle is an active participant in the

Q35: Itemized deductions and the standard deduction are

Q49: Wilma has a $42,500 certificate of deposit

Q52: Corporations are required to file a tax

Q61: Bono owns and operates a sole proprietorship

Q81: Secondary authorities are official sources of the

Q101: An extension to file a tax return

Q117: Future value can be computed as Future

Q123: Workers' compensation benefits are excluded from gross

Q166: The AMT exemption amount is phased out