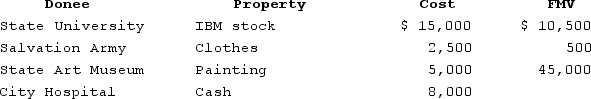

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Definitions:

Hormonal Stress Theory

The hypothesis suggesting that stress responses are mediated by hormones, particularly those secreted by the adrenal glands, affecting the body's ability to deal with stressors.

Chronic Stress

A state of ongoing and continuous stress that can negatively affect an individual's physical and mental health over time.

Immune-System Functioning

The processes and activities through which the immune system protects the body from infections, diseases, and other foreign substances.

Preoperational Stage

Piaget’s second stage of cognitive development, lasting from about two to seven years of age, during which thought is more symbolic than sensorimotor thought.

Q5: Adjusted taxable income for calculating the business

Q29: Bill operates a proprietorship using the cash

Q61: Bob Brain files a single tax return

Q67: Excess business losses are carried back and

Q71: Apollo is single and his AMT base

Q71: Frank received the following benefits from his

Q74: Maria and Tony are married. They are

Q98: Jane and Ed Rochester are married with

Q129: During all of 2020, Mr. and Mrs.

Q152: Cassy reports a gross tax liability of