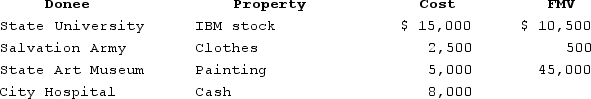

In 2020, Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Definitions:

Abstract Thinking

The ability to think about objects, principles, and ideas that are not physically present, involving complex thought processes such as analysis and synthesis.

Visual Cliff

An experimental apparatus used to measure infants’ perception of depth and their understanding of risks associated with apparent high drops.

Developmental Researchers

Individuals who study the various stages of psychological growth and changes that occur from infancy to adulthood.

Eleanor Gibson

Known for her work in developmental psychology, particularly for the "visual cliff" experiment which studies depth perception in infants to understand their learning processes.

Q15: In June of Year 1, Edgar's wife,

Q39: Bob operates a clothing business using the

Q46: Toshiomi works as a sales representative and

Q60: Alain Mire files a single tax return

Q76: Henry, a single taxpayer with a marginal

Q85: For AGI deductions are commonly referred to

Q87: Which of the following cannot be selected

Q108: If Thomas has a 37 percent tax

Q113: Kaelyn's mother, Judy, looks after Kaelyn's four-year-old

Q174: Jamie is single. In 2020, she reported