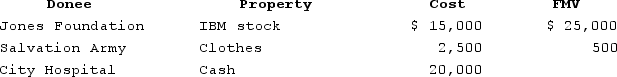

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Definitions:

Contraprepared Learning

A concept suggesting that certain behaviors or responses are biologically more difficult to learn or condition in certain species.

Ultra Prepared

Exceptionally or thoroughly prepared for a specific event or situation beyond usual expectations.

Orbital Frontal Cortex

A region of the prefrontal cortex located just above the eyes that is involved in decision-making, impulse control, and responding to rewards.

Social Context

is the immediate physical and social setting in which people live or in which something happens or develops. It includes the culture that the individual is educated or lives in, and the people and institutions with whom they interact.

Q19: Bart, a single taxpayer, has recently retired.

Q27: Which of the following is a true

Q42: Clyde operates a sole proprietorship using the

Q54: On January 1, 20X8, Jill contributed $25,000

Q68: A fiscal tax year can end on

Q76: Which of the following is not a

Q116: Explain why $1 today is not equal

Q121: Tax credits reduce taxable income dollar for

Q141: Opal deducted $2,400 of state income taxes

Q146: This year Zach was injured in an