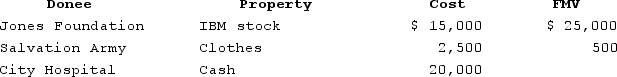

In 2020, Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Definitions:

Regression Models

Statistical methods used to predict the value of a dependent variable based on the values of one or more independent variables.

Reduced Model

In statistical analysis, a simplified model that removes nonsignificant variables while keeping the model's integrity.

Chemical Process

A method or means of changing one or more chemicals or chemical compounds such that a chemical transformation occurs.

Test Statistic

A figure derived from data in a sample for a hypothesis test, utilized to determine if the null hypothesis should be supported or refuted.

Q12: If a taxpayer does not provide more

Q27: From AGI deductions are generally more valuable

Q32: Taxpayers who file as qualifying widows/widowers use

Q36: Ajax Computer Company is an accrual-method calendar-year

Q42: The business purpose, step-transaction, and substance-over-form doctrines

Q68: Alexandra operates a garage as a sole

Q90: Earl and Lawanda Jackson have been married

Q128: Bobby and Whitney are husband and wife,

Q131: Assume that Javier is indifferent between investing

Q136: The constructive receipt doctrine:<br>A)is particularly restrictive for