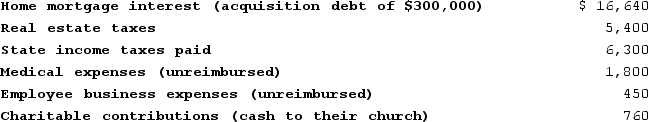

Karin and Chad (ages 30 and 31, respectively)are married and together have $110,000 of AGI. This year they have recorded the following expenses:

Karin and Chad will file married jointly. Calculate their taxable income.

Karin and Chad will file married jointly. Calculate their taxable income.

Definitions:

Equilibrium-Price Relationship

The point at which the supply of a good matches its demand, resulting in a stable market price.

Large Position

Holding a significant quantity of a particular stock, bond, or other financial asset, influencing potential risk and return.

Dominance Argument

A concept in portfolio theory suggesting that if one investment dominates another on all measures of performance, it is the preferable choice.

Risk Premium

The extra return expected by investors for holding a risky asset over a risk-free one, compensating for the higher risk.

Q16: This year, Barney and Betty sold their

Q23: Maria and Tony are married. They are

Q34: Cyrus is a cash method taxpayer who

Q56: Misti purchased a residence this year. Misti,

Q57: Lavonda discovered that the U.S. Circuit Court

Q65: Aubrey and Justin file married filing separately.

Q76: Joe Harry, a cash-basis taxpayer, owes $18,000

Q76: Taxpayers filing single and taxpayers filing married

Q78: What is the tax treatment for qualified

Q98: Jane and Ed Rochester are married with