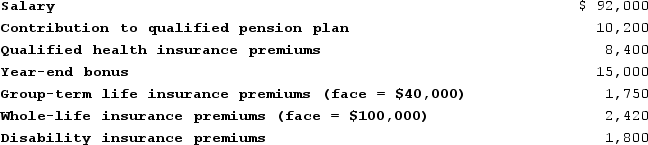

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Definitions:

Tying Contracts

Agreements where the sale of one product (the tying product) is conditioned on the purchase of another, often unrelated product (the tied product).

Sherman Antitrust Act

A landmark 1890 U.S. legislation aimed at regulating competition among enterprises, preventing monopolies, and promoting fair business practices.

Cross-Border Mergers

Mergers involving companies headquartered in different countries with the aim of expanding market reach, efficiency or capabilities.

Sherman Act

An 1890 United States antitrust law aimed at preserving competitive markets by prohibiting monopolies, cartels, and other forms of collusion that restrict trade.

Q9: Lydia and John Wickham filed jointly in

Q16: This year, Barney and Betty sold their

Q18: John holds a taxable bond and a

Q19: Which of the following types of tax

Q27: A loss from a passive activity is

Q41: The capital gains (losses)netting process for taxpayers

Q82: Montague (age 15)is claimed as a dependent

Q89: For married taxpayers filing separately, excess business

Q94: Under the Statements on Standards for Tax

Q145: This year Nathan transferred $7 million to