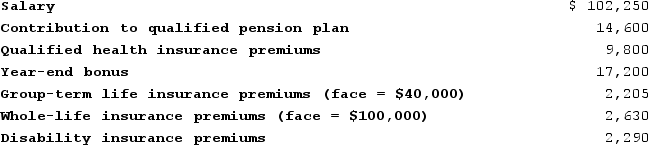

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $7,810 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $7,810 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Definitions:

Utilitarian Justice

A theory in ethics and economics that suggests actions should be judged as morally right if they result in the greatest good for the greatest number of people.

Distributional Justice

The philosophical and theoretical discussions and principles concerning the fair allocation of goods among members of society.

Income Redistribution

The transfer of income from certain individuals or groups to others through mechanisms such as taxation, welfare, and subsidies to achieve economic equity.

Utilitarian Justice

A principle in ethics and political philosophy that actions are right if they are useful or for the benefit of a majority, focusing on outcomes that maximize happiness or reduce suffering.

Q6: Which of the following may limit the

Q19: Harmony reports a regular tax liability of

Q26: Which of the following is a true

Q30: The time value of money suggests that

Q47: Leslie made a mathematical mistake in computing

Q60: The tax law defines alimony to include

Q61: This year Maria transferred $600,000 to an

Q74: The gross estate will not include the

Q106: Which of the following is not true

Q117: Which of the following is NOT a