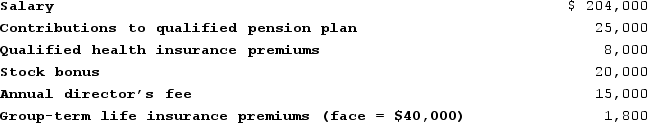

This year Joseph joined the board of directors for a company. Besides his director's fees, Joseph received the following employee benefits:

The stock bonus consisted of 5,000 shares of Bell stock given to Joseph as compensation. At the time of the transfer the stock was listed at $4 per share. What amounts, if any, should Joseph include in gross income this year?

The stock bonus consisted of 5,000 shares of Bell stock given to Joseph as compensation. At the time of the transfer the stock was listed at $4 per share. What amounts, if any, should Joseph include in gross income this year?

Definitions:

Midway Island

A small, strategically significant atoll in the North Pacific Ocean, notable for its role in a pivotal World War II battle between the United States and Japan.

Allies

Countries or entities that join forces or cooperate for a common purpose, often referring to the allied countries against the Axis Powers during World War II.

Norman Rockwell

An iconic 20th-century American painter and illustrator known for his depictions of everyday life in the United States, capturing the spirit and culture of the nation.

Q15: All investment expenses are itemized deductions.

Q43: Rachel is an accountant who practices as

Q55: Boeing is considering opening a plant in

Q63: The constructive receipt doctrine is a natural

Q71: Apollo is single and his AMT base

Q101: Kathryn is employed by Acme and they

Q101: At his death Titus had a gross

Q116: A withdrawal of money from a bank

Q119: Regardless of when a divorce agreement is

Q124: George purchased a life annuity for $3,400