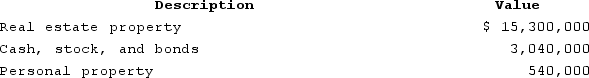

Sophia is single and owns the following property:

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for $3.4 million. Sophia was only able to provide $680,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for $3.4 million. Sophia was only able to provide $680,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Definitions:

Financial Control

The management of an organization's revenues, expenses, and assets to improve financial efficiency and effectiveness.

Small Business Failure Rates

The percentage of small businesses that do not succeed or cease operations within a certain period of time.

First Five Years

A period often referencing the early stage of an entity's existence, crucial for development and long-term success.

Operation

A series of actions or steps taken to achieve a particular end.

Q9: Shauna is a 50 percent partner in

Q19: Which of the following statements regarding tax

Q41: Jenny has a $54,000 basis in her

Q44: The federal transfer taxes are calculated using

Q52: The timing strategy becomes more attractive if

Q64: Which of the following is not a

Q88: Businesses must collect sales tax only in

Q112: Inventory is substantially appreciated if the fair

Q119: Caleb transferred $115,000 to an irrevocable trust

Q146: Jackson is the sole owner of JJJ