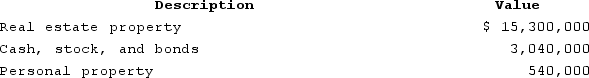

Sophia is single and owns the following property:

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for $3.4 million. Sophia was only able to provide $680,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for $3.4 million. Sophia was only able to provide $680,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Definitions:

Expected Sales

Projected revenue that a company anticipates earning from the sale of goods or services in a future period.

Ending Inventory

The total value of goods available for sale at the end of an accounting period.

Master Budget

An all-encompassing financial plan for an organization, covering all of its operations and financial activities within a specific period.

Operating

A term relating to the daily activities of a business that are necessary for it to run and make a profit.

Q35: Which of the following exceptions could cause

Q38: Gabriel had a taxable estate of $16

Q40: All of the following represent a type

Q73: When considering cash outflows, higher present values

Q82: Distributions to owners may not cause the

Q85: Gordon operates the Tennis Pro Shop in

Q100: If Paula requests an extension to file

Q113: At the end of last year, Cynthia,

Q116: For purposes ofdetermining filing status, which of

Q138: Gordon operates the Tennis Pro Shop in