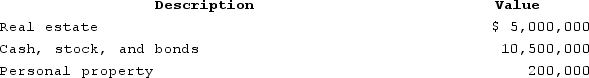

At his death in 2020, Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

Definitions:

Minimization

The act of reducing or diminishing the significance, impact, or size of something to its smallest possible level.

Problem Focused

An approach that concentrates on identifying and addressing specific issues or challenges directly.

Breast Biopsy

A medical procedure where a small sample of breast tissue is removed and examined for signs of breast cancer or other conditions.

Distractible

Characterized by a lack of concentration and too easily drawn away from the task at hand.

Q20: Assume that Keisha's marginal tax rate is

Q23: C corporations that elect S corporation status

Q44: Compare and contrast the constructive receipt doctrine

Q49: Which of the following is not a

Q50: Lamont is a 100percent owner of JKL

Q53: Assuming an after-tax rate of return of

Q57: Lavonda discovered that the U.S. Circuit Court

Q75: CB Corporation was formed as a calendar-year

Q94: When a partner receives more than a

Q116: The annual value of rented property is